The golf business has maintained most of the momentum it picked up during the COVID-19 pandemic.

And the continued strength of this industry — a winner resulting from behavioral changes which took hold during the pandemic — will be one of the more interesting economic subplots to track in 2023.

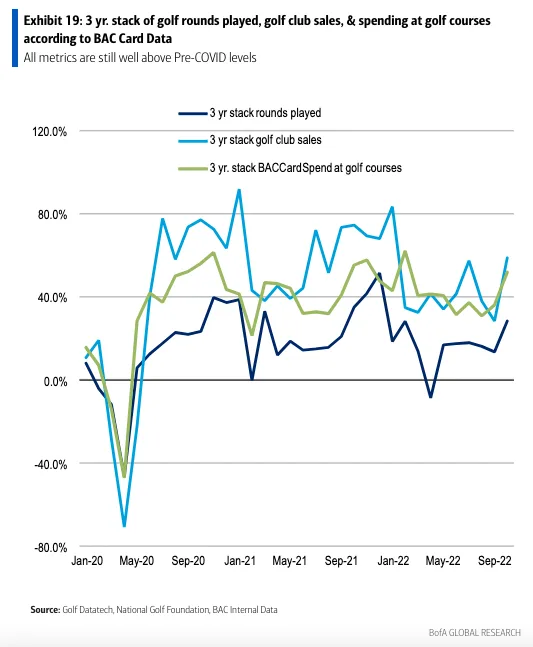

A new report from analysts at Bank of America Global Research out Tuesday showed an acceleration across rounds played, club sales, and spending at golf courses in October, a surge the firm attributes to Hurricane Ian weighing on September results.

Spending on golf in 2022, however, has moderated overall as the explosion in popularity seen in 2020 and 2021 has cooled. Spending on clubs dropped 7.2% from the prior year in October, while rounds played were down 1.1%, according to Bank of America.

But when compared to 2019, BofA finds spending on all three major categories for golf — clubs, rounds, spending at courses — remains well above pre-pandemic levels.

When looking at the biggest public companies in the golf business, the results are a bit more mixed, though mostly positive.

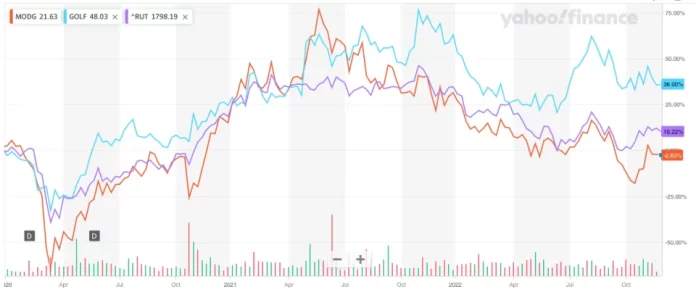

Since the start of 2020, shares of Acushnet (GOLF), which owns the Titleist and FootJoy brands, are up 35% against a 10% gain for the Russell 2000.

Topgolf Callaway (MODG), in contrast, is down about 2% over that period as the company has focused on building its Topgolf business and moved away from the pure-play “clubs and balls” Callaway business.

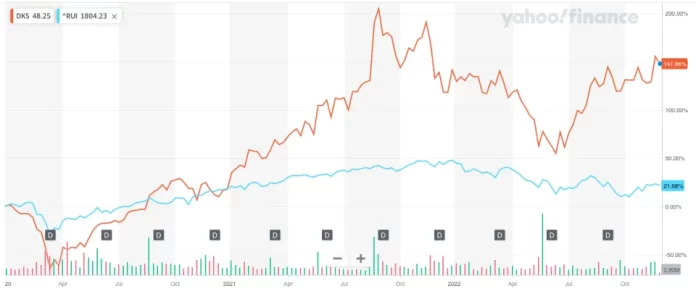

And as for the retailer most exposed to golf, the story has been a clear winner.

Dick’s Sporting Goods (DKS), the retail name most exposed to golf in BofA’s coverage, has been a bonafide success story since the onset of the pandemic, gaining more than 140% against a 21% gain for the Russell 1000 since the start of 2020.

The story for Dick’s, of course, goes beyond the course. Dick’s has benefitted from trends like working out at home and spending more time outdoors by selling gym equipment, bikes, fishing gear, and Yeti (YETI) coolers to consumers who spend their leisure time differently in 2022 than they did back in 2018.

Taken together, we think the recent stock price performance of companies exposed to golf suggests investors have a bit of a mixed outlook for the sport heading into 2023.

The success of Dick’s shows continued investor belief in getting outside; the lagging performance of Topgolf Callaway presents some questions about golf’s endurance as a lifestyle play.

And all of this leaves out the endless upheaval seen in the professional golf world over the last several months, which looms as a potential fringe impact on the sport’s ability to pull consumers.

The surge in retail stock trading, a frenzy for homebuying, and a shift towards spending on goods over experiences are all pandemic-era behaviors that seemed paradigmatic at the time but have turned out to be booms of varying sizes now cooling as our habits normalize.

And so as investors enter 2023 with a growing number of questions about the health of the economy, and as we continue to witness the cooling of some pandemic-enhanced trends, whether golf can continue its newfound consumer energy will be a fascinating subplot for markets in the year ahead.