The most enduring gift bestowed on our planet by the ethnic English was, well, English, the language.

Is it the most flexible communications tool ever conceived by man?

Put an ‘a’ in front of moral, and you create a conundrum, its polar opposite.

If P is silent in pneumonia, or psychotherapy, it pops along like machine gun fire in peanut, people and Pino Grigio.

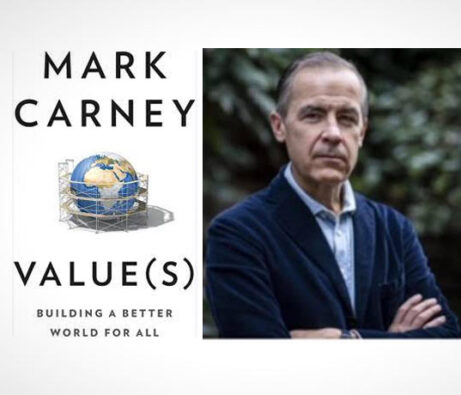

Pluralization might be the subtlest change-agent of all, as a book published in 2021 consistently points out.

Value(s) is a 500+ page-turner based on “financial humanism” which, at first blush, looks like a contradiction in terms.

It is written by Mark Carney, the former head of the Bank of Canada and England.

The (s) in the title is a deliberate attempt to create a paradox, a double meaning.

The divide between value and values is having a profound effect on society.

Writes Carney: “Value in the market is increasingly determining the values of society. We are living Oscar Wilde’s aphorism – knowing the price of everything but the value of nothing – at incalculable costs to our society, to future generations and to our planet.”

This is both a guidebook on how to succeed in business, and a morality play, writ large. It also provided me with the tools needed to decipher two stories that have bedevilled me (and the entire golf industry) for the past two years: the creation of the LIV Golf Series, and a possible framework agreement between the Saudis Public Investment Fund (PIF) and the PGA Tour.

Carney said institutions putting value ahead of values are walking on a carpet of flowers that covers the abyss.

Remember the rise and fall of Bre-X, Enron, Lehman Brothers, Arthur Andersen, and Madoff Investment Securities? Led by biz school sharpies who viewed themselves as Masters of the Universe, these fraudsters, greed-mongers, and miscreants like Bernie Madoff ran their companies into insolvency, which put a whole bunch of butts behind bars.

This form of casino capitalism ushered in the dark days of the 2008-09 recession, and created what Shakespeare called, a “new age of poverty” in our money markets.

Carney focused on two isms (realism and humanism) to show how savvy business leaders have to hold tight to a firm’s core principles. What’s good for society is also good for your business, and rolls out some powerful numbers to prove his point.

A 2016 study found that when companies had high investment in the issues material to their industry, and low investment in issues immaterial, they outperformed the market by 4.83 percent. Environmental Social & Governance (ESG) initiatives have become strategic imperatives for successful organizations over the past few years, driven by the old Social Responsible Investing (SRI) model. Companies that divest interests in corrupt companies or rogue regimes (like apartheid-era South Africa) saved themselves from future disaster.

Modern-day pariahs like Saudi Arabia and its enormous (US$778 Billon) Public Investment Fund (PIF), now uses “sportswashing” to help wipe away its sins.

Can you remove blood from hands after years of human rights abuses, bribery, corruption, gender inequality, ritual killing, and Murder One?

The majority of terrorists who turned commercial airliners into weapons of mass destruction on 9/11, were Saudi nationalists. The country’s current leader is Mohammed bin Salman (MBS), the dark prince. He is “credited” with forming a gang of baddies to plot, murder, and dismemberment regime critic and Washington Post reporter Jamal Khashoggi. This brigand of killers had a bone saw as the 15th club in their bag.

Amnesty International calls the House of Saud “The Kingdom of Cruelty,” and Human Right Watch said Riyadh has created a nasty way of putting rivals to death. In 2022, 148 people (more than double 2021) were executed, and re-creating images from the Dark Ages, 81 met their fate in one hellish day. Most were killed after unfair trials on trumped-up, protest-related charges.

Stakeholders have their say

Why would the PGA Tour spend over 100 years building up its brand, then do the dirty with the Saudis?

Exactly, say golf purists, who recoil at this bastardization of the game. Even an old-guard tour player like Hal Sutton called out the tour on a recent Golf Channel interview. He said he has wiped his hands of the game at the highest level because he doesn’t recognize it any more. What does it stand for, he asks? He answers his own question: money, I guess.

The tour is a sporting anomaly: its not-for-profit tournaments have donated $3.6 billion to charities – exceeding the combined totals of the NFL, NBA, and Major League Baseball.

You might find golf boring or elitist, but you can’t criticize its altruism. This is why over 100,000 people gladly volunteer each year to ensure tour stops run as profitably as possible.

The tour also prides itself on a unique governance model as well. It’s all based on meritocracy. In theory, each tour player starts the year with zero earnings, and plays in a unique and competitive format to secure his standing for next year. To me, this makes it the purest sporting product on the planet.

That all changed in 2020 with the arrival of LIV – drenched in Saudi blood money, guaranteed contracts, wonky rules of play, and a team format.

The PGA Tour’s governance model has already changed its 2024 schedule to be more LIV-like: limited-field events, no cut, and guaranteed payouts.

The proposed PGA Tour-Saudi agreement will create a new company called PGA Tour Enterprises, and PIF governor Yasir Al-Rumayyan gets a seat on the tour’s policy board. He will chair the for-profit LLC, with current PGA Commission Jay Monahan its CEO.

Monahan insists Saudi influence will be slight, but anyone who has sat on a corporate board, knows money doesn’t talk, but shouts, and then influences.

No one seems to have a clue how this will work, but we do know this: if a deal smells like cheese left on the kitchen counter for a week (which this one does), then it should be throw out.

The Norman conquest

The head Saudi sap is Greg Norman, former No. 1 player in the world, and affectionately nicknamed Shark during his successful playing days. He now swims freely with them as overseer of LIV. Like most predators, when he smells blood in the water (the PGA Tour’s money problems), he moves in for the kill. The recent signing of No. 3-ranked Jon Rahm for upwards of $300 million, is the latest Shark bite. When he was introduced by Norman, I half-expected to hear the ominous theme from Jaws to be playing in the background.

In our postmodern world of mass suggestibility, where everything is lies and spin and alt-facts, Norman is the perfect pitchman. He keeps a straight face when saying sportswashing isn’t the purpose behind Saudis attraction to golf. If that whopper won’t work, he tries another: LIV is on a mission to free the poor serfs now struggle to earn a living on the PGA Tour. Or this: LIV is all about growing the game. He has repeated it so often, it has been stripped of all meaning.

The only connection between the Kingdom of Saud and golf appears to be the fact that from a certain height, it looks like a giant sand trap. Under that sand lies pools of pure crude, easily extractable. This is what fuels PIF’s portfolio of sports: soccer, tennis, boxing, snooker, Formula one racing, and now, golf. No wonder the Kingdom is the only bidder to fund and host the 2034 World Cup.

Speaking of ominous. When Wells Fargo, a sponsor for 20+ years, said that it was pulling sponsorship of its tour stop in Charlotte, North Carolina in 2025, it blamed the added costs of a Signature event, and a new funding model which piles the extra costs on tournaments and their sponsors. This, according to Sports Illustrated, has created a groundswell of dissent, even disgust.

And what or who replaces the $30+ million the tournament raised for local charities?

Canadian Mackenzie Hughes, living in Charlotte, feels for fans and communities that have benefited from a tour stop. “Charity used to be a huge priority on tour,” he said, “but has now taken a backseat. LIV has overvalued the worth of golfers. That has ruined our perspective. The tour money is unsustainable.”

Canada at the crossroads of change

Our national men’s championship has been at the crosshairs of all this change since storied St. George’s Golf & Country Club in Toronto hosted our 2022 RBC Canadian Open. It was the first tour stop to go head-to-head with LIV, and began with the shocking news that Team RBC member Dustin Johnson had bolted to LIV just days before. The news came with little warming, and no apologies. In fact, his image was still on posters to market the event only days before it teed off. I remember a marine-like layer of gloom hanging over the fabled course, and many fans wondered if this was the last time they’d see the PGA Tour in all its carnival-like splendor.

Monahan was so shaken by LIV’s entry, he flew to Toronto to join CBS host Jim Nantz in the broadcast booth on Sunday, baring his soul to an international audience. He spoke with the piety of a preacher, as self-righteousness oozed from his pores. He said: “I would ask any player that has left, or any player that would ever consider leaving… have you ever had to apologize for being a member of the PGA Tour?” His eyes moistened slightly as he added: “I just look at how life is all about meaning and purpose, and we’re an organization with meaning and purpose.”

I guess Mary DePaoli, executive vice-president and chief marketing officer at RBC, was impressed, because when I sat down with her in the post-tournament press room, I asked if all disruptions over the past week had had an adverse impact on her or RBC’s view of continuing their title sponsorship?

Mary DePaoli: Executive Vice President & Chief Marketing Officer at RBC

She insisted stakeholders, especially RBC, had total faith in Monahan to lead the PGA Tour through these tumultuous times.

A year later, and the tour was back in Toronto, at Oakdale Golf Club, and Monahan was back on site, this time carrying a different message, and looking more diminished – all self-righteousness rung out of him.

His message not only reverberated throughout the golf world, but was lead item on most prime-time newscasts.

The PGA Tour had negotiated a “framework agreement” with the Saudis, setting the stage for a possible partnership by the end of this year.

PGA pros met the news with a collective WTF. They spoke to the press through gritted teeth, eyes narrowing, heads shaking.

So, this is how staying loyal to the Tour gets rewarded was the most popular sentiment, followed by words like “blindsided, turncoat,” and “betrayed.”

Monahan was fried and fricasseed by the press.

Afterwards, he announced he was taking a leave of absence from his job for medical reasons.

Was it a bad case of indigestion after having eaten so many of his words?

My only regret in not attending Open week at Oakdale, was a chance to follow up with DePaoli, and ask her this: So, what do you think of him the commissioner now?

Troubled tour gets its comeuppance

To be fair, the PGA Tour once operated in a moral void, too, its closets rattling with skeletons. The gargoyles that once infested the different golf associations around the world (RCGA, USGA, and R&A) did their best to keep the game small, restrictive and all white.

History will not forget the PGA Tour’s membership policy which featured a “Caucasian-only” rule. Iconic players like Nicklaus and Palmer once led the charge to ban a disabled player named Casey Martin from using a golf cart to compete on tour. They were finally slapped down by a ruling from the US Supreme Court ruling, citing the Americans With Disabilities Act.

The R&A once allowed its Open Championship to be hosted by the Honourable Company of Edinburgh Golfers (Muirfield), whose club once featured a sign on its lawn that said: NO WOMEN OR DOGS ALLOWED.

Feminists waved placards at the home of the Masters for the club’s men’s-only membership rules.

Augusta National remained the granddaddy of overt racism when during and after the Jim Crow era of racial segregation in the deep south, they kept “the coloreds” in their place and in the caddy yard.

Yes, the game has joined the 21st century, but the smell of mendacity lingers still, and a potential partnership with Saudi Arabia (aka Murder Incorporated) will quickly send it back to the Dark Ages.

If golf fans of a certain vintage find this “greedflation” of the disturbing, they certainly aren’t surprised. It wasn’t so long ago the NHL, NFL and NBA had to fend off challenges from new leagues, which pumped up player salaries before their money ran out. Nothing can match the deep-pocketed Saudis who, unlike the WHA, USFL, or ABA, don’t need a return on investment to continue to disrupt the game of golf.

The post-Oakdale reaction to this potential PIF-PGA Tour partnership was swift, and telling. The US Senate called Tour executives to Washington to explain the deal. They also urged representatives from PIF to speak, too, but Saudi is where transparency goes to die.

Al-Rumayyan was a no-show.

Yasir Al-Rumayyan – head of Saudi Arabia’s Public Investment Fund

Norman was busy polishing his Lamborghini.

One Senate lawmaker said it would continue to look into this deal with the devil. The Department of Justice is nosing around, too, which is not a good look for a game who once operated in bubble-wrapped impunity.

That’s because it operated under Royal & Ancient rules of play, and a chivalric code of behaviour where players actually call penalties on themselves.

There was a moral clarity in the sport, which was consistently reinforced by its charitable arm.

Hypocrisy dogs Monahan’s each step, and the secretive backroom deal proves that over the past two years, he has learned an important lesson: how to speak out of both sides of his mouth.

All quiet on the RBC front?

Canada’s iconic corporate giant RBC, remains tightlipped about its future in golf. The 2024 PGA schedule is out, and they’re in on title sponsor of the both the RBC Canadian Open (Hamilton Golf Club) and the Heritage Classic (Hilton Head, South Carolina). The latter is a Signature event played the week after the Masters, while our Open is saddled with another dog of a date. For the first time in its 120-year history, it will start in late May. Once touted as the tour’s 5th Major, it has dwindled down to clichéd irrelevancy, a northern version of the Sanderson Farms Championship.

The “reimagined” ‘24 PGA Tour schedule, could see another change: protests.

Those who oppose Saudi financing, and human rights violations, and the country’s connection to the horrors of 9/11, saw families of victims of Saudi violence waving placards at many LIV events.

The expiry date on RBC’s deal with Golf Canada (our national sports organization) was set to expire this December, but has been extended for another year. The bank will continue its side-hustle sponsorships of Women’s Golf Day, our amateur teams, and community program like RBC Community Junior Golf and the RBC PGA Scramble. It is all-in our First Tee initiative, and its famous logo will remain affixed to the sleeves of ‘Team RBC’ players.

Carney knows how commercial banks are risk-averse and wary of controversy, especially since RBC serves upwards of 17 million clients in Canada, the U.S., and 27 other countries. With a market cap of over $180 billion, and management of $597 billion worldwide, some of its clients might recoil if its PGA Tour partner is playing kissy-face with Murder Incorporated.

The law of diminishing returns might best describe RBC’s involvement with the fatal pact.

The bank’s mission statement on human rights is quite clear, and a quick Google search reveals this….

“RBC endeavours to respect the Universal Declaration on Human Rights, the International Covenant on Civil and Political Rights and the International Covenant on Economic, Social and Cultural Rights in addition to the International Labour Organization’s Declaration on Fundamental Principles and Rights at Work.

We recognize the responsibility of governments to protect human rights. If applicable laws in countries in which we operate contradict with our commitment to respect human rights, RBC will seek ways to promote respect for human rights to the greatest extent possible.

We will strive to avoid causing or contributing to adverse human rights impacts through our own business activities and will aim to prevent and mitigate adverse impacts to which we may be directly linked by taking appropriate action.”

RBC issued an ESG Report in 2021, and It hails its “Power of Purpose,” which hopes to tackle some of society’s greatest challenges in countries where it lives and work. Its ‘Future Watch’ program will pour $500 million over a 10-year period to assist youth prepare for the jobs of tomorrow, and it will continue to push for a net-zero world. The RBC Foundation continues to flourish and work for charities, and matches many of the initiatives of its PGA partner.

With a risk-averse culture that’s based on “Doing What’s Right,” it has doubled-down on articulating its “Values.”

David McKay, the president and CEO of RBC, states this in his company’s Code of Conduct: “Values define what we stand for everywhere we do business.”

All this leaves me wondering how this all squares with the PGA Tour if it does decide to do the dirty with the Saudis?

As I write this, Monahan and Al-Rumayyan are scheduled to meet this week to discuss their plans for an agreement that was supposed to be decided before year’s end.

Ah, yes, Values. The soul of financial humanism. The title of Carney’s book.

This multitudinous man, who currently resides it Toronto, is the U.N. Special Envoy for Climate Action and Finance and the U.K.’s Finance Advisor for COP26. He also a vice-chair of Brookfield Asset Management and Head of Transition Investing. His concept of a coming Fourth Industrial Age driven by an eco-sensitive green sector, fits his humanistic approach to finance. As economic advisor to Prime Minister Justin Trudeau, some see him as his rightful successor.

When Carney led the Bank of England, he read the wise musings of Roman Emperor Marcus Aurelius’ Meditations. It became his vade mecum, the object of his obsession. It focuses on living a pure, simpler life.

Carney was particularly struck by these words: “arise to do the work of mankind.”

For a short period of time, that seemed the mantra of PGA Tour as well.

This is what made it unique from other sports leagues.

It’s what made it such a valuable partner for a company like RBC.

The Tour wasn’t perfect, but had a tenderhearted side, and the percentage designated to help its fellow man put it at the forefront of all sports leagues.

Its sense of civility seems shattered these days, and the danger for partners like RBC, is being attached to a tour that might drag behind it the rotting carcass of the Saudi regime.

Maybe it will find new financing from a different, less controversial source?

Maybe government will step up to stop this potential partnership?

Maybe the players (who own the tour) will finally toss out Monahan, and put the boots to this dirty piece of business.

Carney said in his book that businesses have to build bridges to the future, not the past.

Extremis capitalism that has helped ruin this planet’s eco-system, and has widened the gap between rich and poor, doesn’t have a humanistic bone in its body.

RBC’s support for our national Open began in 2008, and has broadened ever since. Its long list of Team RBC players has been a marketer’s delight. Then came 2002, and everything changed.

Dustin Johnson bid adios to the Tour, and Team RBC.

Harold Varner III was hired to represent RBC’s diversity program to help open up golf for all. He split, too, taking LIV money.

This past summer I attended an outdoor party that was well attended by a dozen or so retired RBC executives. I cornered two of them and asked point blank what they thought of the potential partnership between the Saudis and the PGA Tour, and what role RBC might play if this deal eventually goes down.

Both suggested the bank feed their golf portfolio into the company shredder.

This prompted me to ask another question, this time to myself: What if the tour and Saudis do a deal, and RBC extends its sponsorships?

Then, my friends, all bets are off.

As a long-time RBC client, I promise to protest by undepositing my slim holdings.

I’ll do it in honour of Khashoggi, a fellow journalist.

I’ll do it, for all the families who lost loved ones in 9/11, and protested at last year’s LIV events.

I’ll do it because my beloved mom was a life-long RBC client and there was nothing more enjoyable for her than a visit to her local branch, which she always called “The Royal.”

Even when she was dying, I would pick her up and drive her to do her bank. She knew all the tellers on a first-name basis, and they knew her. She was always treated Royally.

I’ll do it because my mom was also a humanist who believed countries that violated the human rights of their own people, or caused chaos and death around the world, weren’t worth a plug nickel – the same as the people who did their bidding.

I began this rant by talking about my love of the English language, and how its flexibility and multiple usages has changed our world.

Its greatest practitioner, Will Shakespeare, is said to have invented over 1800 words.

One of them was “uncomfortable,” which pretty much sums up many of us in the golf business feel these days about a proposed agreement between the Saudis and the PGA Tour.

A moral void will be injected into the tour that will change it forever.

The untranslatable charm of the old pro tour will be consigned to the scrapheap of history.

I’m picturing RBC and Golf Canada executives right now, sitting around the boardroom, as conflicted as any of us.

If you or any of them need help in making a decision of whether they should remain loyal to this tour, I suggest everyone pay a visit to Chapters and pick up Carney’s book.

He’ll explain the difference between value and value(s).

He’ll lay out the real long-term costs of doing business with a scoundrel.

I urge you to focus in on his chapters on values-based leadership, and building a purposeful company.

Carney’s book is written in plain English, which makes all-powerful.

It left me with one profound takeaway: it always pays off to follow your value(S).